The Metaphorical Eye of Sauron Sets its Sights on Youth Sports

Institutional investment in youth sports is on the rise— is that ultimately a good thing?

Somehow it feels like over a decade has passed since a landmark ruling broke the dam that prevented college athletes from being able to use their own name, image, and likeness (NIL) to make money. In reality, it’s only been four years since NIL payments became legal, and the amount of money that has since flooded into the NCAA to the athletes, the colleges trying to attract those athletes, and to new businesses being constructed around the whole NIL market boggles the mind. Athletic Business estimates a total of $1.67 Billion will be spent in 2024-25 on NIL deals, and as a one-off example, On3 already estimates that Duke basketball rookie Cooper Flagg has already signed over $4.8M in NIL deals as a freshman. In a matter of years, athletes, companies, and investors have already made millions in the world of college athletics, and despite the intertwining of NCAA sports with academic institutions for young people, this doesn’t feel too wrong.

For decades leading up to the NIL ruling, sentiment grew that college athletes putting their time and health on the line for colleges and universities to exclusively profit on their work felt wrong. Now, the fact that so many student athletes are making money for the work they effectively provide to benefit their schools feels earned and appropriate. However, something starts to feel a little bit weirder emotionally and mentally when you start to draw this same thread upstream into youth sports, which in and of itself is already a $30 Billion industry. Similar arguments can be made about student athletes in high school and even middle school providing benefits to their schools, and it’s easy to see the same forces that unlocked the college sports industry as a hotbed for investment turning their attention further upstream into youth sports.

It’s like the proverbial Eye of Sauron searching for the next great sports-related investment opportunity… so let’s dive into a high-level overview of youth sports investing and its future!

The Backdrop

Investment in youth sports represents a particularly challenging grey area to navigate in a seemingly moral and virtuous manner. However, it is easy to justify investing in the world of youth sports under the mission (or perhaps the guise) of wanting to increase access to, and participation in, youth sports. Later we’ll dig into some of the specific factors that have recently degraded youth sports participation, but this altruistic underpinning of most financial interest in the youth sports industry really needs to be scrutinized closely. It’s important to constantly pose the question: “is this new company or investor actually increasing the accessibility and quality of youth sports to improve their benefits?” The wide range of answers probably won’t surprise you…

Whether it’s perceived as beneficial or detrimental, investors are waiting in the wings to inject money into the massive youth sports industry opportunity. Already, 2024 was packed with startup funding rounds, partnerships, and a myriad of mergers and acquisitions that has sparked other writers and investors like Aaron Miller and Lomi Patel to post some great pieces with a focus on private equity (PE) investment in the space. To understand their (and my) observations about the investment cases for youth sports, I think it’s important to understand how capital can actually be deployed as investment in the space. To this end, I’ve pulled out what I believe are the eight most common investment targets for PE funds, venture capital groups, and even non-profits looking to boost youth sports with some concrete examples from 2024:

Playing/Training Infrastructure: Municipalities, non-profits, and for-profit companies all make major investments in sports complexes, new fields, arenas, gyms, and training grounds for young athletes, including a $98M investment in a women-focused sports complex in Indiana by Marvella. These investments can come in the form of either public or private infrastructure, with the latter seemingly becoming more common.

Parent/Coach Education: Greg Olsen’s Youth, Inc. received $5M in Seed Funding from Will Ventures in 2024 to create a direct-to-consumer platform to help parents, coaches, and league managers understand the broader youth athletics space and financial opportunities within it. The company’s focus is shared by many others, and focuses on trying to fix some of the stove-piped elements of the industry. Products that aim to solve these challenges for coaches and parents are often managed by national sport governing bodies like USA Hockey, for example.

League Infrastructure: Tackling the same distribution problem as Youth, Inc. from a completely different angle, Rocket Youth raised $100M to acquire, support, and effectively unify the operation of independent sports leagues across the country. Their beachhead resides in some slightly less popular sports like gymnastics, lacrosse, and volleyball, but they are starting to expand in youth basketball and $100M goes a long way! NBC Sports Next has also partnered with Stronger Youth Brands to provide its league-management infrastructure to support their network of youth leagues that manage 600,000+ athletes.

Team Infrastructure: Companies like LeagueApps which provides individual youth sports teams with all the the tools they need to manage everything from rosters to team dues raised a new funding round in 2024, building on an existing $35M in startup investment. They are looking to dominate an extremely crowded market of team- and club-management platforms abundant across the world today. Similar to league infrastructure investments and startups the main goal here is often to provide a new software tool or platform that consolidates disparate users.

Scouting/Prospecting: Youth sports scouting tool leader Hudl recently acquired FastModel Sports to expand its supported sports, and baseball-focused Perfect Game acquired Top Gun Sports’ huge swath of youth baseball leagues to streamline their scouting business. Hudl and many others provide both athletes and coaches with tools and a platform to share and review players’ performance in youth sports.

New League Creation: Early in 2024, private equity firms combined their youth sports holdings into a new company called Unrivaled Sports. Later in the year, Unrivaled launched a new nationwide Football Youth program that will host a major flag football league and tournament, and provides football players key resources for growth. Investment in new leagues is becoming popular at every level of sport (especially the pros), and youth sports is no different— everyone is looking for the next hit game.

New Product Creation: Companies are constantly designing and commercializing new sports products like equipment and apparel. The sporting goods industry might be one of the most crowded markets on the planet, though few companies focus exclusively on youth sports. However, there were some new companies formed or funded in 2024 whose products focus on fun youth games, and one of my favorites was the triple-sided basketball hoop created by 360 Hoops. Is it ridiculous? Of course. Would be a blast to play on at a playground as a kid? Absolutely.

Media and Promotion: I’ll be honest, this is by far the area that I know least about, but self promotion for individual athletes and teams is becoming a critical component of the modern sports landscape. Somewhat ironically, I actually think much of the execution of this process is done through existing scouting platforms like Hudl and through existing social media. However, I’d be shocked if there weren’t more sports-focused avenues for self-promotion trickling into youth sports like we’ve seen in the NCAA with NIL platforms.

Despite my pulling examples of each type of investment from last year only, it’s worth noting that institutional money in some form or another has been funneled into youth sports for a long time. Especially outside the US, European soccer clubs like FC Barcelona and Bayern Munich have long supported their own internal academies that serve as soccer-focused alternatives to traditional schools for star youth athletes starting as young as under-9 programs (which is quite different from the US). While youth sports leagues like AAU basketball and Pop Warner football are non-profit organizational entities, there are many leagues youth sports and even more high-caliber camps and teams that function as for profit businesses. Again— the argument for their existence is that they improve the outcomes of the players in their systems, but perhaps this comes at too high a cost.

Outside leagues and teams, though, companies that fall into every category above have long sought to leverage to the youth sports market. Behind these companies, there are investors and stakeholders looking for strong returns too. Most notably among the high school scouting and game planning department is the aforementioned Hudl, who has taken on over $100M in funding from investors that include the universally adored Bain Capital (sarcasm). Similarly, companies like Adidas and Nike thrive in the long run if they are able to capture the youth sports equipment markets, so it’s a major focus of their charitable and partnership efforts.

The list of examples could go on and on. However, if it feels like there’s a sudden flurry of activity in the youth sports market right now, it’s almost certainly an inclination of prior trends, not a completely new step change in investor interest. “We didn’t start the fire” or something that…

The Future

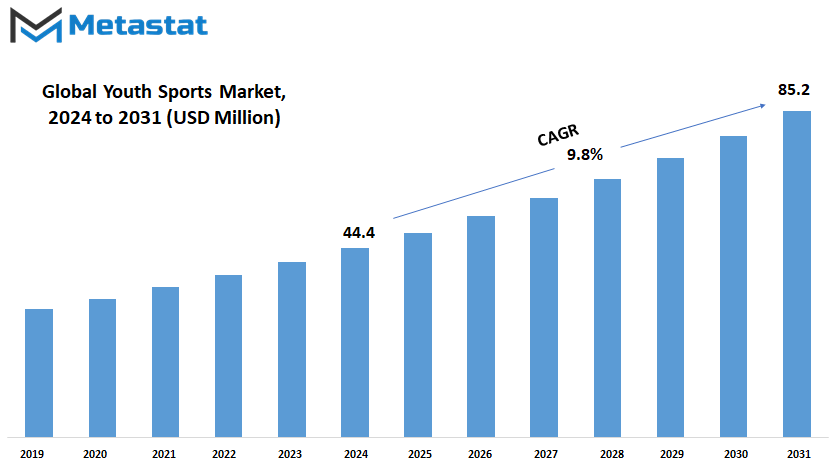

The fact remains, though, that private investment in the youth sports space seems to be on the rise— or at least the publicity surrounding this activity is growing. Part of this increased investment pace and associated exposure is certainly the result of strong growth projections for the youth sports industry overall. Market researchers consistently predict approximately 9-10% compound annual growth rate (CAGR) over the next five years, an extremely high growth rate not found most other places in the sports market (e.g. the struggling hockey gear market). As a rule, I generally expect investors “herd” their projections for these longer time-scale studies since they typically release multiple years in a row and it’s easy to copy work.

Interest in investing in youth sports has gotten to the point that Forbes even released a short article outlining best practices for investors in the space, if you need an indication that things seem to be going “well.”

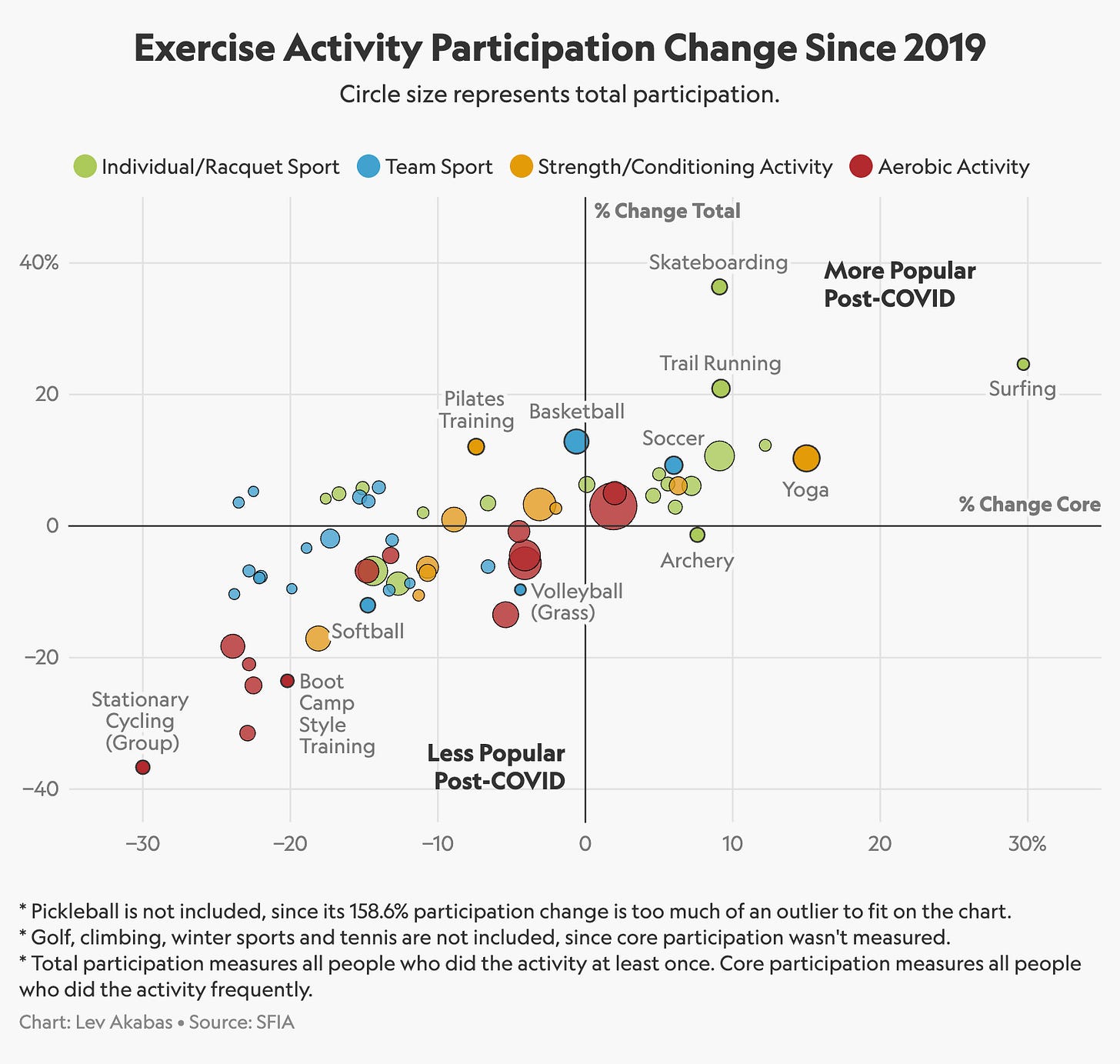

What makes investment in youth sports so tantalizing extends beyond just the projected growth into the specific, structural opportunities in the space. First, the underlying balance of growing and receding sports within the world of youth sports is always changing. Since COVID, individual and small-team sports like running and skateboarding have seen an explosion in popularity, while larger team sports like baseball/softball and football have deteriorated somewhat. This ebb and flow of popularity naturally breeds additional new market and product opportunities and investors are on the hunt to ID the next big individual sport that could explode in popularity.

Second, the stove-piped nature of the youth sports industry makes it an extremely attractive space for infrastructure products, which is why they feature so heavily in the investment list above. Companies that can either provide services agnostic of the type of sport like scheduling or league management services can ride the popularity of the rising sports no matter what they are. On the other side, products that provide a universal service within a specific sport have very high promise as well, which can either take the form of hardware infrastructure like a sports complex, or once again software platforms that can help schedule leagues, manage rules, and more.

There are a lot of Sequoia’s “Hard Fact” product-market-fits in the youth sports industry due to its distributed and disparate nature that make for very high ceiling investments.

Of course, it’s extremely difficult to predict the future, but I believe it’s a practical certainty that we’re going to see continued, and likely accelerating investment in the world of youth sports across nearly every category listed above. In particular, I expect that we’ll see further privatization of high-caliber camps and leagues, and a big push in youth sports infrastructure products, both as software platforms and physical infrastructure. Somewhat to my own surprise, I’m not entirely convinced that the youth-focused sporting goods will receive a large focus from investors, though this perception might make it a less crowded market in which to compete!

The Impacts

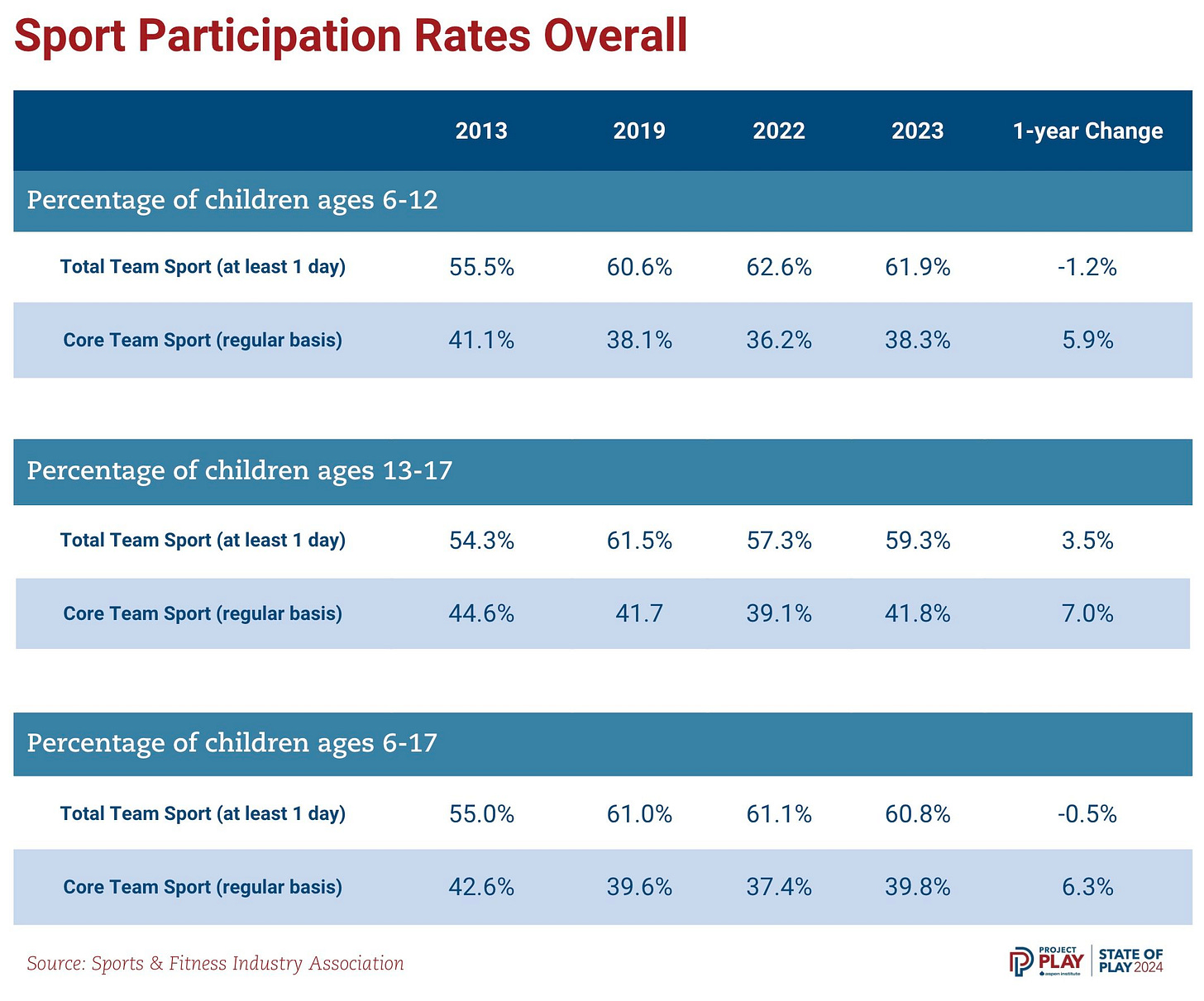

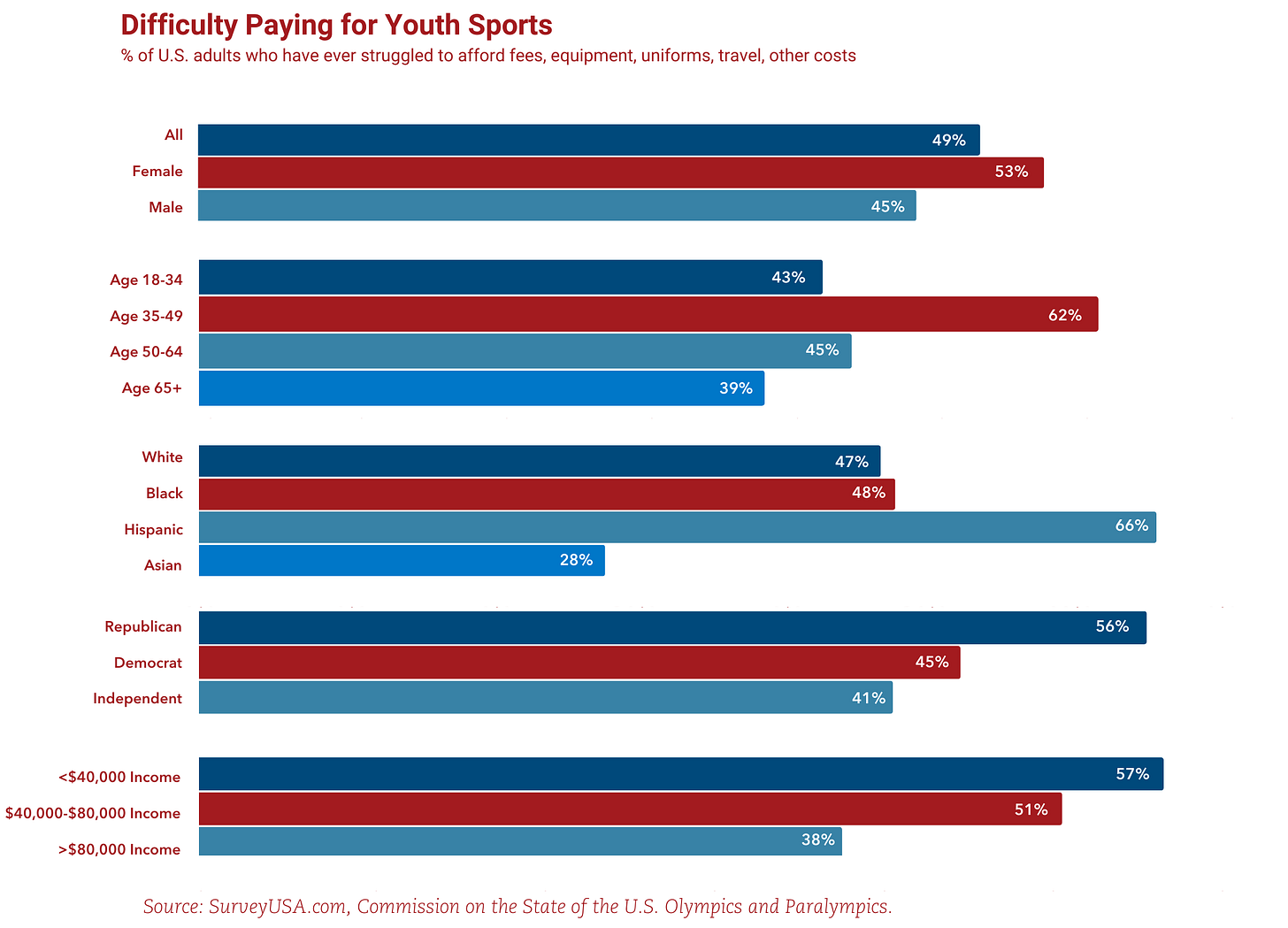

One of the core conflicts in the figures above is that the overall market size of the youth sports business projects to increase ~9% annually for the next half decade, but we’re currently on a trajectory to reduce core (ongoing) participation in youth sports. To me, this combination of factors signals that the overall cost per athlete of youth sports may increase in the years to come, which in turn might actually reduce the number of athletes playing youth sports. In the list of investments from 2024, many of them increase the quality of youth sports for many athletes at the higher end of the performance power curve. However, it seems like very little is focusing addressing potential cost barriers for the “fat tail” of the distribution— the vast majority of more casual youth athletes that aren’t interested in paying more to become elite, but want to participate nonetheless.

There is no doubt that youth sports already push the boundary of affordability for many Americans. Anecdotally, it seems like overall child care costs are on the rise more broadly, and some studies suggest that ~50% of parents in the US have struggled at some point to finance the youth sports activities of their children. Herein lies the natural tension with all the investment opportunity described above. For an equipment brand like Nike that is needs to generate more revenue to appease shareholders, or CCM in the hockey gear market that needs to increase margins for its new PE owners, price cutting is not likely to occur in the short term. Increased competition due to investment flooding the youth sports industry with new companies might eventually drive down prices and increase accessibility for all, but I am a bit skeptical about any short-term improvements.

Interestingly, the ambiguity surrounding short-term gains or losses in terms of access are a shield for current investors, with one major (positive) exception. I do think (and Sports Business Journal agrees) that investment in youth women’s sports is definitely increasing the access and quality of the products available to athletes. On top of this, a professional sports career for female athletes is much more feasible than it was even 10 years ago, which has its own secondary effects including increasing participation at the youth level. While this boom is happening, though, people are already questioning the impact of the encroaching private equity into youth women’s sports. I am a little concerned about a bubble beginning to form in the broader professional sports league industry and I do hope that newly formed women’s sports leagues aren’t negatively affected, leading to a retraction in youth participation, but that is a topic likely deserving of its own article.

Overall, I think the current acceleration of investment in new youth sports leagues, startups, and infrastructure lured in by the huge TAM of the market will continue for multiple years. I do expect these new companies and products will help solve real challenges in the industry, particularly related to organizing teams and leagues to make a more ubiquitous positive experience. However, I don’t necessarily expect this boom in the quantity of cash and number of players to really increase access to sport in the short-term, even if it does increase the quality of play for more elite youth athletes. This growth in the number of players in the market across every target area listed above will naturally lead to consolidation (and potentially even higher prices) at some point in the future.

I firmly believe that parents are averse to blatant commercialization of industries associated with raising kids, so at the very least it’s going to be an extremely interesting process to follow, even from the sidelines.

The Roundup

Something that has stuck in my mind throughout the research and writing of this article is that the state of popular youth activities, ranging beyond just sports to areas like theater, and arts, and academics, and even general hobbies like gaming — are a reflection of the values of the parental generation, blended with the trends of the day. We’re starting to get to the point now where younger parents are being exposed to the meteoric financial rise of the sports business as a whole, which absolutely colors the way that everyone views youth sports right now. Concurrent with this boom is an underlying decrease in youth sports participation (especially in team sports), which leads me to believe that the current trends of the day are starting to ebb interest away from youth sports as a whole. Youth sports as an overall construct are not going to disappear any time soon, but something feels strained within the industry right now.

If I was looking to invest in a youth-centric market, I’d be trying to look around the corner at what core skills and experiences youth sports was uniquely capable of providing in the past, and trying to spot what other youth activities can now provide those same benefits. Surely gaming online with friends or on an esports team, or participating in a highly complex stage production can provide many of the same mental benefits as a sport, and perhaps there are other means to achieve the same physical output! It feels somewhat sacrilegious, or at least somewhat funny to say, but I might even look explicitly beyond traditional sports into other areas that have the chance to grow rapidly in the modern youth activity landscape.

Similar to every other industry, youth sports benefits from economies of scale that make team dues, field bookings, equipment, and even nutrition less expensive than they’d otherwise be in smaller markets. I am quite nervous that the youth sports industry could find itself in a positive feedback loop that shrinks the overall participation by young athletes significantly while increasing costs for those still at play. If you can’t tell, I’m generally a bit nervous about the current monetization trajectory of sports right now.

However, to make sure I don’t end on a dour note, it is absolutely worth repeating that the flood of capital entering the youth sports market right now really does have some promise to yield enormous quality of life improvements and increased access in the world of youth sports. I wouldn’t write this article if there wasn’t some interesting tension to analyze in this market, but part of the tension is driven by all the promise for improvement!