The Present and Future of Publicly-Traded Sports Companies, Part 1/2

Gear companies, venue management firms, entertainment brands, and more!

Obligatory: This article is not financial advice and is to be used for entertainment/educational purposes only.

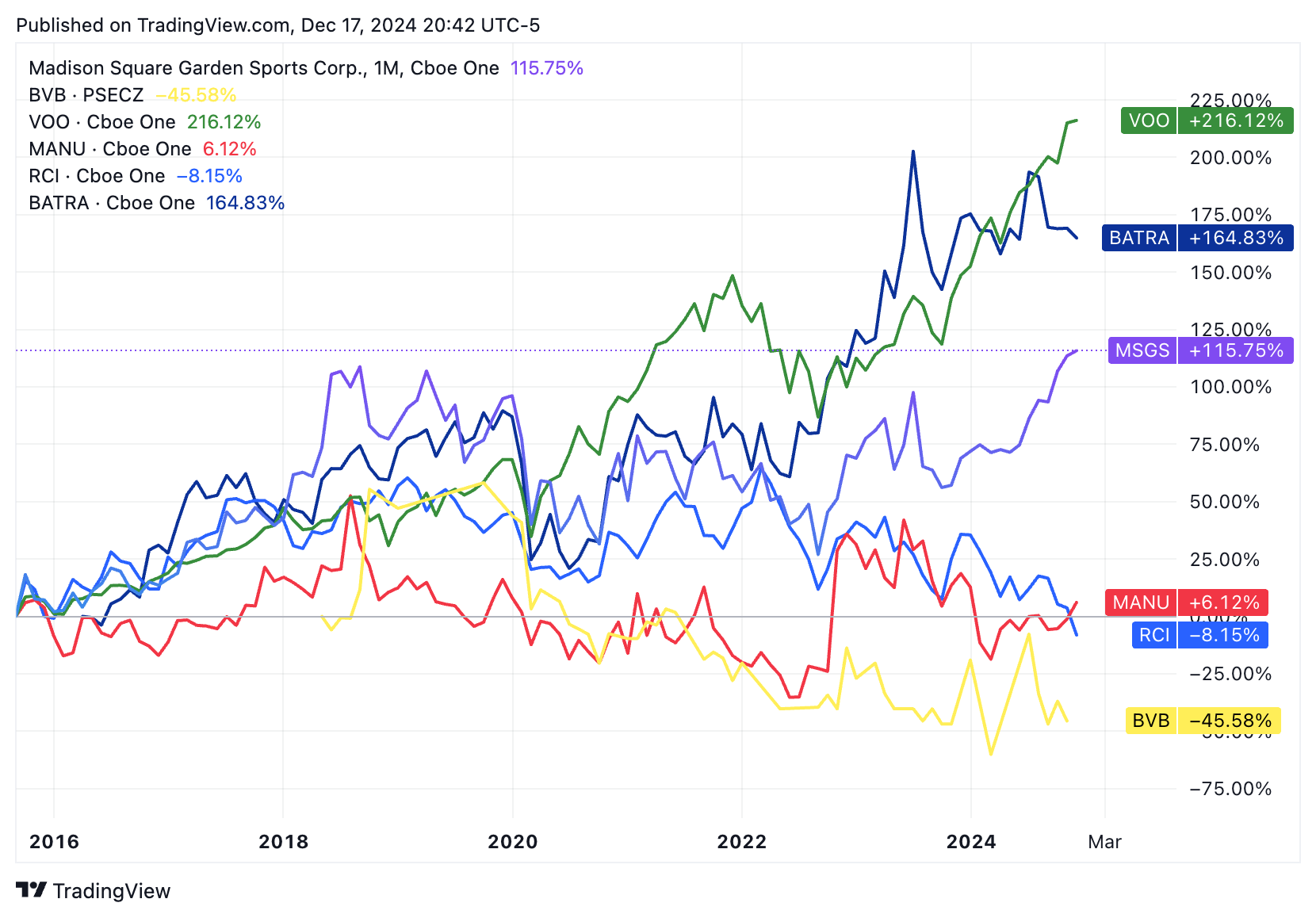

Earlier this year, a surprise article hit the my inbox via Google alert, titled “TECH TUESDAY: Equity Listings Are a Slam Dunk for Sports Teams.” Apart from appreciating the appropriately pithy title, the assertion that publicly listing an individual sports team was a no-holds-barred great idea seemed suspect. I’d considered the thought of an individual sports team being traded on the stock market in terms of what the future might look like, but it turns out that reality is already here! If you’re so inclined, you (yes you!) can go out and purchase your very own stake in teams such as the Atlanta Braves, Manchester United, Borussia Dortmund, or even the Knicks and Maple Leafs through their parent organizations (Madison Square Garden Sports and Rogers Communication respectively). However, if you invested in any of these teams nearly a decade ago in 2015, you’d unfortunately have been better off investing in a S&P 500 index fund (e.g. VOO), despite the constant narratives about the explosion in value of pro sports team.

This prompts multiple questions. First, I thought public equity listings for individual teams were a “slam dunk,” so why have existing publicly-traded sports teams provided worse returns than a relatively standard index fund in recent years? Second, aside from individual teams, what other types of publicly-traded sports investments are out there? Both great questions, the former of which we will tackle in Part 2 (of 2) in this series, and the latter we’ll dive into here to lay some broader market context for the teams themselves. The more I dug into the world of public sports-related companies, the more interesting the research became, but this first article might lean slightly more informational and when we actually seek to answer questions surrounding the performance and pros/cons of publicly listed teams, there will be a lot more analysis (conjecture).

And as it turns out, a huge variety of sports-related companies are available to trade on public markets, ranging from industry staples like Nike and Lululemon to massive gear conglomerates like Anta Sports to entertainment empires like the TKO Group. There aren’t too many sports-related sectors that don’t have at least one public company, and I wanted to highlight some of the major players across different types of companies. To over simplify slightly, most (non-team) public sports-centric companies break down into a limited set of categories, with some integrating either vertically or horizontally across multiple markets. Most of these markets also involve catering to either professional/collegiate athletes or the general public, with few companies targeting both customer bases. Notably, I’ve left distributors (e.g. Decathlon, Dick’s, etc.) off this list, although they are playing an increasing role in product design and manufacturing as well!

Without further a ado, though, let’s explore these market segments below:

Gear Companies

Companies that design and manufacture gear like sports equipment, apparel, and shoes are perhaps the most abundant public sports companies, and come in three main types: 1) large companies that make nearly every type of gear for most popular sports, 2) smaller companies that tend to focus on more specific or niche sports product categories, and 3) massive brand conglomerates that control a very surprising amount of Type 2 companies.

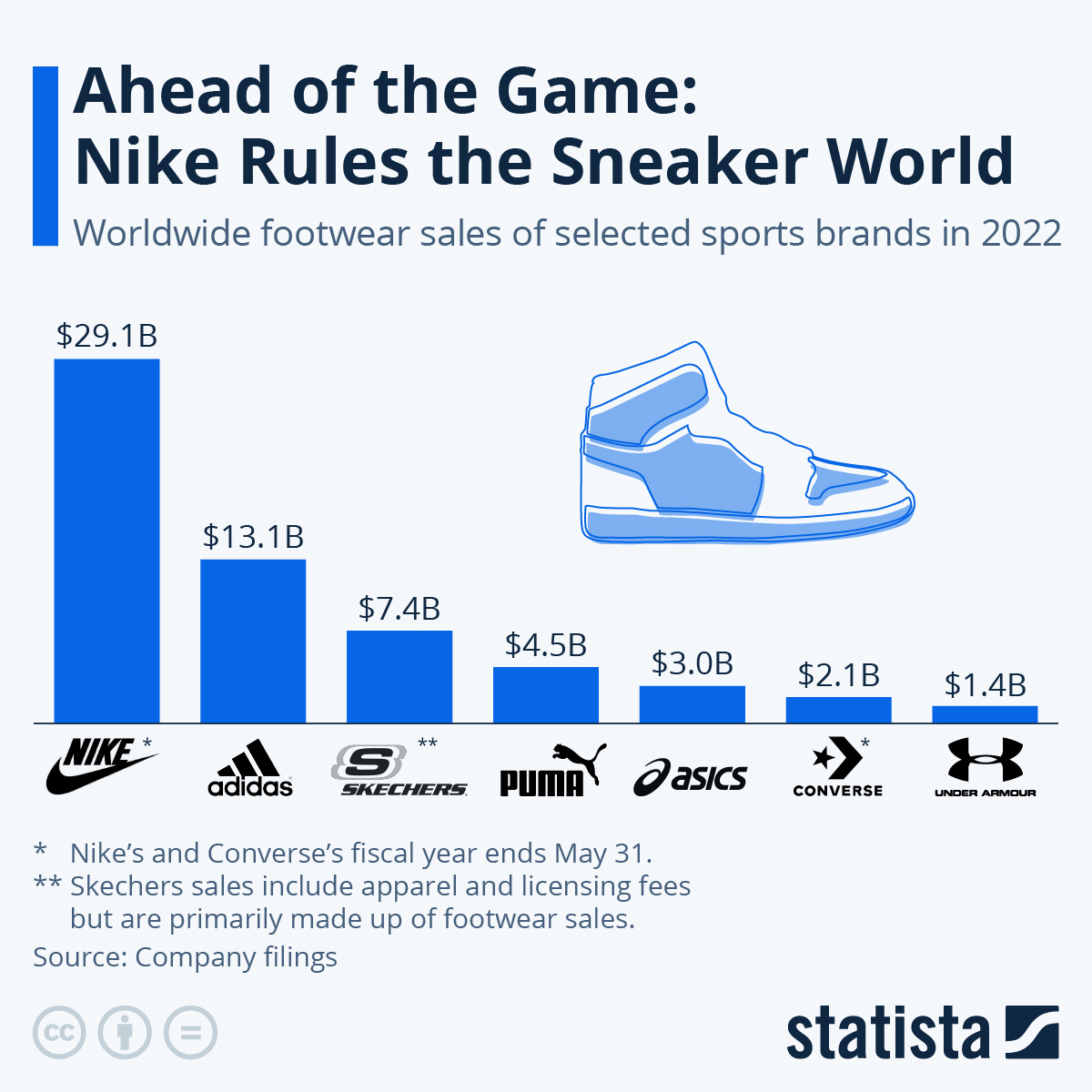

In Category 1, Nike and Adidas represent the global “Big 2.” Even with declining revenues and so many new competitors entering an already crowded space, these two own a combined 25% market share for sportswear. A wide variety of brands serving a wide variety of athletic gear markets sit beneath these giants including Lululemon, Under Armour, Puma, On, and Anta (who will pop up again later in this section). It’s worth noting again that some distributors have also started creating their own in-house brands, which will drive even more competition in this space, especially in the lower budget range. Most of the category 1 companies are large and ambitious like Nike and Anta, or driving for constant growth like a more traditional startup like On and Lulu. As a result, it’s not super surprising that this ilk of company are often listed publicly.

Outside of the major companies targeting a wide range of customers across multiple sports, you enter the realm of smaller, more focused sports companies (Type 2). The list of public entities in this segments includes a surprising (to me at least) set of companies like Columbia Sportswear, Skechers, Asics, and Callaway. Each of these companies tends to focus on something specific— Callaway with golf, Skechers with footwear, or Columbia with outdoor gear. As opposed to the Type 1 mega-corporations, it’s not entirely clear to me what benefit each of these companies derives from being publicly traded, and how it actually affects decision-making internally. The selection of small, more specific sports gear companies that have gone public feels a bit more random than the more ubiquitous pursuit for the giants in the industry.

The final tranche of sport gear companies are the large conglomerates in the space, that acquire and partner multiple smaller (Type 2) gear brands together. This group opened my eyes to just how many sports gear companies are actually publicly-traded. To start at the top though, the biggest public sports gear conglomerates in the world are: Amer Sports (owned by Chinese umbrella company Anta Sports), Wolverine World Wide, Deckers Corporation, and VF Corporation. Some of these you may have heard of (like Anta), and others might be complete unknowns (like VF for me). However, their combined portfolios include many companies most people have probably heard of:

Arc’teryx

Salomon

Wilson

Atomic

Louisville Slugger

Merrell

Saucony

Stride Rite (for all the tots reading this article)

Chacos

Hoka

Ugg (for all the hygge athletes recovering from workouts)

Teva

Altra

IceBreaker

The North Face

JanSport

SmartWool

Jansport

Vans

I am sure you’ll recognize at least a few names on that list, and if you’re like me, you’re blown away by certain inclusions, and how many companies are rolled into these conglomerates. I think the furtiveness of these company’s association with their parent company is intentional, and aimed at serving their more grassroots ethos, especially for outdoor brands. Interestingly, Adidas once played this type of brand empire role more aggressively as well, acquiring the likes of Salomon, CCM, Reebok, TaylorMade, FiveTen, and more. They still own some of these brands, but have since cooled their acquisition spree of the early 2000’s.

Even without their participation though, the size of the collection of smaller, popular sports and outdoor gear brands that are rolled into publicly traded conglomerates is surprisingly large. I don’t know whether it’s the most practical business strategy in the long-run with so many new sports startups hitting the market, but at the very least it’s a straightforward way to grow!

Health & Nutrition Companies

To my own surprise, there aren’t too many standalone health and nutrition companies on public stock markets (and zero sports-specific ones at that). The obvious candidates in well-known sports drink and nutrition rivals Gatorade and Powerade are owned by PepsiCo and Cola-cola respectively. Coca-cola also recently acquired BodyArmour, PepsiCo purchased Muscle Milk in 2014, and the general consolidation of these types of nutrition brands mimics broader acquisition patterns in the consumer packaged food industry. Even older, pioneering sports-specific nutrition companies like Clif Bar and Power Bar have been consolidated into larger holding companies!

However, there currently seems to be a groundswell of currently privately-owned sports and nutrition brands popping up left and right, with the likes of LMNT, Honey Stinger, Maurten, Skratch, Science in Sport, Tailwind, and countless others building their own sports nutrition brands. Slightly broader nutrition brands like Herbalife have gone it alone and IPO’d, though they’ve since struggled to maintain momentum. I am certainly curious to see if any of the new batch of sports nutrition companies will attempt to follow a similar path, or if they will end up being pulled into the industry giants! Perhaps economics of scale are really the only long-term key in this industry.

Tech Providers

As sports- and fan-related data collection, ownership, and distribution jave become more valuable, software startups like Genius Sports and Sportradar took early leaps to go public in 2021. Both companies saw relatively steep declines in value post-IPO, but sports teams, leagues, broadcasters, and sportsbooks continue to grow their demand for the in-sport analytics/data, and the fan/social data generated by these companies. Unfortunately, Genius and Sportradar are competing with a very wide variety of private companies, including individual sports teams like the Miami Heat, who have spun up their own venue, fan, and team analytics company!

These companies are also competing with tech giants such as Amazon, who is becoming increasingly intertwined with the NFL, IBM, who is expanding further into combat sports, and Oracle, who is dominating the Formula 1 field. Even Sony has stayed very active in this space, with their athlete tracking and Hawkeye camera systems— their most exciting product line since the Playstation 2! The world of live data capture and sports analytics has every chance to become extremely stove-piped, and if the Heat are any leading indicator, maybe every individual league or teams will end up having their own solutions long-term if the associated costs are low enough.

On the wearable technology front, where hardware and software combine, Catapult Sports represents the sole major standalone public provider. Almost all other companies in this market are still private (E.g. Zebra, Kinexon, or StatSports, which is a nearly identical company). These companies focus on athlete tracking and data gathering, but a lack of underlying tech differentiation may make their overall businesses suffer long term. They all rely predominantly on a combination of GPS, IMUs, and UWB Radio to track position and activity, with only slight differences in sensor and data capture mechanisms. These companies face serious threats from computer-vision based products as well in terms of accuracy and sensing method, while startups like Nextiles are looking to better integrate the hardware portion of these products by deploying smart-fabrics and new tech. I am definitely a bit concerned Catapult and others may get caught in a technical no-man’s land.

Interestingly, this whole sector of products, both software-only and hardware alike are both threatened in the long-term by the decline of team sports participation! One of possibly a few markets with plausible existential threats (queue transition to Sports Gambling).

Sportsbooks

Perhaps the most widely-advertised companies in this article (which is saying something given their lower collective market cap) are sports gambling companies. As opposed to legacy gambling and casino companies with broader gambling and entertainment assets, startups like DraftKings and FanDuel (Flutter Entertainment) have focused on, and quickly went public on the back of the federal legalization of sports betting in the US. Sports betting continues to be legalized in more states, but the reluctance of the final holdouts to legalize it, and a growing aversion to sports gambling’s ubiquity highlights the regulatory and legislative risk exposure of these companies. As a result, it’s quite interesting that most of the major sportsbook companies are public— even many of those legacy casino companies!

Legacy entertainment and casino operators like Penn Entertainment (who actually runs ESPN’s sportsbook), MGM Resorts, and Caesars Entertainment entered sports betting as an extension of their broader gambling empires. These companies are all publicly-traded entities as well, but unlike the pure sports gambling entrants like DraftKings and FanDuel, these firms can rely on slightly more diversified revenue streams. As a result, though, they are also trailing these two sports-focused companies when it comes to actual sports gambling engagement. New startups are now trying to compete in the existing sportsbook market, and infrastructure companies are being built around sports gambling (like Genius Sports), but of all the markets in this article, this might be the most risky in the long run. If I were a betting man, I don’t know which way I’d predict the cards will fall!

Entertainment / Broadcast Entities

I’ve bucketed these types of companies into one category for the sake of brevity, though in reality they could be split out into two separate groups. Publicly traded companies like Madison Square Garden Sports Corp., and Rogers Communications (yes, the Canadian cell company) host events at their stadiums, but also manage broadcasting and communication infrastructure for their teams and arenas. TKO Group Holdings, which owns the UFC and WWE, strays further from venue manager into pure entertainment and broadcasting entity, with some of the most popular live events on the planet. Outside of these companies, though, there aren’t many public sports-specific entertainment and broadcast entities, as many major networks and media companies have subsidiaries or departments that run their sports coverage.

These major broadcast and media companies include many household names like ESPN (owned by Mickey Mouse), NBC, FOX, and Turner among many more. Very notably, this market is also starting to become a more popular pursuit for streaming companies as well, with the likes of Amazon Prime and Netflix paying big dollars for exclusive events. Just this week, FIFA announced that Netflix will have exclusive rights to stream the next two women’s World Cups! The sports media landscape is extremely crowded, and as broadcast rights get split out to new streaming and television entities, I think it will continue to become more convoluted before it gets simpler…

Sporting Venues

If you’re a lover of “infrastructure for BLANK” companies, then looking at sport venue and event management companies might be for you. As opposed to some of the other market segments on this list, most sports venue management companies appear to be privately owned. Some major exceptions on the public market aimed at professional sports venues include (once again!) Madison Square Garden Sports and Rogers. It might lean slightly towards conjecture, but I think one of the biggest reasons there aren’t more publicly-traded venue management companies is their reliance on public funds from taxpayers to actually pay for the stadiums and arenas, which is becoming extremely unpopular for most governments in the US and overseas.

Moving away from professional sports venues, though, there are some interesting consumer-focused sports venue companies like Churchill Downs (yes, the Kentucky Derby race track ownership group), Sphere Entertainment, and Vail Resorts. Each of these companies is completely unique from the others, and of the three, Vail Resorts is perhaps the most interesting. They have gone out and competed against Alterra Mountain Company to acquire ski resorts around the world despite potential unit economic challenges with skiing and existential threats due to climate change. It’s a bold strategy that landed them in a Noah Kahan song, but has really exploded their value since the early 2010’s. In general, I do think that public consumer-focused, and especially youth-sports-focused venue management companies might become more prevalent as these fields continue to become more lucrative.

What’s Missing?

Apart from the clear absence of sports leagues in the list above, I thought it was interesting that no athlete representation companies (that I could find) are publicly traded. It’s very possible that revenue is too inconsistent or sustained growth is particularly difficult to manage that they don’t make desirable offerings, but I could also drum up reasons why most types of public business would not be sought after businesses! It might also be the result of stove-piping within the representation/agency industry as a whole— where individuals and small groups of athletes may be represented by one person or company, but short athlete careers and a huge pool of agencies to chose from means most businesses aren’t large enough to IPO.

In any case, we’re left with the following market map for types of public sports companies. In an effort to keep it simple and easy to read, I haven’t pulled every example from this article and beyond, but especially for gear companies, I may do this in the future!

On the flip side, professional sports leagues and even many professional teams are certainly large enough to warrant being publicly-traded entities if they so desired, and participating in an industry growing as fast as sports could be the icing on the cake. Which brings us all the way back to one of the original operative questions: What the heck is going on with the performance of existing publicly-traded sports teams, and is professional sports teams going public actually a good idea more broadly?

Unfortunately both answers (or at least some speculation about the answers) will have to wait until the new year after the next Geek Locker Roundup and last publication of the year. Please stay tuned for both articles, I’ll be sharing some additional details about what’s to come in 2025 and beyond!