Sports Tech Startup Trends of 2024, Part 1

Who is making investments, and where is money flowing?

Every day, it seems like more and more hype builds around sports entities as a financial growth mechanism. CNBC recently kicked off a sports-focused business channel, the NFL is considering opening team ownership to private equity (PE) funds, and companies like On and Hoka have taken huge bites out of Nike and Adidas’ market dominance. Money is flooding to sports-specific investors in the hopes of taking advantage of this gold rush. As this money gets spread across the sports market, it should nourish new sports technology and entertainment companies— so what types of companies, technologies, and sports are actually seeing this money?

Part of my reason for starting this blog, and more specifically the bi-weekly roundup, was to put a finger back on the pulse of the sports tech startup world. An accidental result of this effort was a database of startup and sports tech investment events from the first half of 2024 that inadvertently help answer questions about the flow of funding into new ventures. While my compilation of 80 sports tech investments and incubator selections may not be completely comprehensive it definitely provides enough data to extract investment trends from the first half of the year. I will definitely write a retrospective on the entire year’s sports tech investments, and perhaps even vet it by trying out a free trial to Crunch Base or the Sports Business Journal.

Specifically, the sports technology investment trends I wanted to investigate are: 1) the types of products (e.g. hardware/software), 2) the target sports of the companies, 3) the product markets (e.g. nutrition, apparel, data analytics), and 4) what types of investments are being made. Of course, it wouldn’t be an overly ambitious blog post without some conjecture about what the results indicate about the near future of the sports tech market as well.

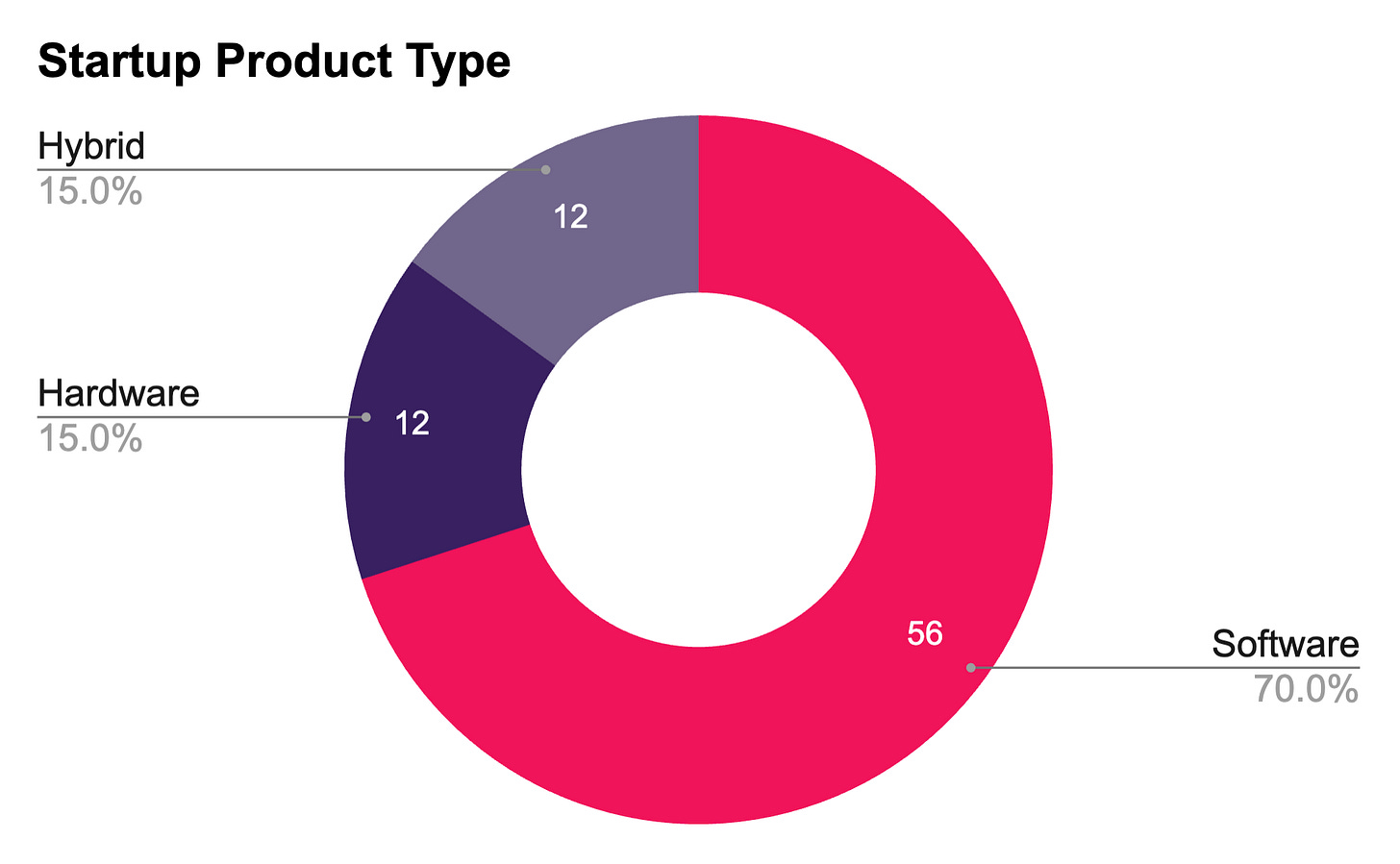

In general, software startups more frequently receive early-stage funding than hardware or hybrid (software & hardware) companies do. Software company growth is typically more rapid and requires less upfront investment for capital expenses, and in an industry as competitive and cutthroat as sports and entertainment, it might stand to reason that software companies would dominate funding and founding announcements. And, even despite the sports technology market inherently centering around games that take place using physical products (even for esports), this basic logic holds true: the large majority of funded and incubated startups in H1 2024 produced software products:

Software-only companies composed 70% of the 80 investment announcements, incubator inclusions, and self-funded launches in the first half of 2024. Hardware-only companies made up 15% of the companies, and hybrid software-hardware companies filled out the remaining 15%. Interestingly, of the 12 hardware-only companies, 4 , or 33% made headlines through a self-funded company launch or product release. I think this distribution likely says more about the appetite of venture capitalists (VCs) and other investors than it does about the product and market opportunities for software and hardware companies. As it turns out, many software-only product markets in sports tech are actually quite crowded.

The distribution of the markets in which new companies are competing shows an aggregation in media, fan engagement, analytics, infrastructure, and sports equipment. Of these segments, the first four are dominated by software-only products, and the sports gambling/fantasy sports market saw more than five investments made in the first half of the year, not counting the numerous acquisitions made companies like Fan Duel and Draftkings. With the broad apparel and gear markets seeing only two commitments, it’s pretty clear that software products oriented at fan experience and engagement are the current darling of the sports tech investment world.

There are some notable differences in the types of companies that were invested vs. incubated. Startup incubators leaned more into analytics, fan engagement media, while investors spent more time with infrastructure-, league-, and sports gambling-related companies. A major reason for this split might be the types of incubators themselves. Three leagues (the MLS, NBA, and UEFA) and NBC Sports (a broadcasting company) incubated ~3/4 of the companies, which naturally down-select to companies more linked with media and engagement, often to realize short term gains. Alternatively, those making early stage financial investments focused disproportionately on sport infrastructure and sports gambling/fantasy. I’m not surprised that leagues would avoid incubating sports gambling companies, and for investors looking to invest in companies for future IPO or acquisition, broad infrastructure plays may provide much higher upside, but less tactical short-term use for leagues and media entities.

Across the board, though, investors and incubators are taking most bets on companies that are aiming to launch a product that is generic to all types of sport. Of course, most products have a beachhead market, but their technology is explicitly stated as applicable across the world of sports. From all 80 investments and incubations in the first half of the year, nearly 3/4 were for sport-agnostic. Of the non-generic startups, golf actually saw the most individual upstarts, while baseball, unfortunately saw 0, which was quite surprising given that even chess saw a sport-specific investment in H1 2024!

Digging into the financial commitments of the investments is quite interesting as well, though it’s worth noting that where funding information is not available, I did not attempt to predict investment sizes. So while private funding information is not shown, the chart below reveals an even heavier bias towards plays in the Media space. The extremely high investment into the Sport/League is exclusively derived from an $80M Series C investment into basketball league organization Overtime Sports, but the $100M+ invested into Media companies was distributed relatively evenly across 9 companies, revealing a broader appeal of these pursuits. I was surprised to see funding was relatively evenly distributed across all other categories (except equipment startups), which may indicate general appeal throughout the rest of the sports tech industry.

Of the investments with public information, there is a local maximum number of investments in the $0-$500k range, dominated by seed funding rounds. There is also an increase in investments in the $2.5-$5M range, a local peak for Series A rounds. There appears to be another peak in the $10-$25M range, but this histogram bin for the investment range is much broader than the others. In general, I would expect most investment size distributions to look like a Rayleigh curve when bucketed in equal investment ranges. In total, though, about $360M in startup investments were made in H1 2024.

The prevalence of small-dollar investments is reflected in the distribution of funding rounds as well, where seed rounds and self-funding are most common— making up over 50% of startup announcements. More formal Series A-C announcements only comprise ~20%, and unnamed funding rounds ~25% of the total. It surprised be how many investments didn’t have a more formal delineation like Series A-C, but perhaps growth equity investments, bridge funding, and other funding vehicles without formal names are becoming more common.

On the complete other end of the spectrum from the small-size seed rounds, we do see a TON of money being poured into sports-specific VC and PE funds. In the first half of 2024, funds were able to raise over $9B in capital to invest in sports, leagues, startups, and more— over $12B if you count Fenway Group’s massive $3B investment in the PGA! I believe that the vast majority of these funds are aimed at making investments into individual professional teams, which is likely corroborated by the large gap between the investment dollars entering the world of sports, and the amount ($360M) being invested in sports tech-related startups. Notably, though, this flood of capital into sports teams likely increases the price and value associated with winning the two key ships— championships and viewership, which will inevitably increase the already growing investment we see in sports-related technologies.

At the end of the day, is this deluge of capital good for the health of the overall sports/entertainment and sports tech industries? I think I have different answers for each.

In general, sports have seen relatively organic, exponential economic growth over the past few decades. It makes me skeptical, then, that increased outside investment into teams and leagues will really make things better for these entities. Decisions about the long-term health of teams and leagues may give way to short-sighted investment return decisions that hamper future viability. It makes me nervous as well that so much money is being invested in individual teams while fandom becomes more diluted across leagues and players due to sports gambling and fantasy sports. I don’t really mean to be a predictor of doom or demise, but it makes me nervous about a potential “bubble” for the overall sports and entertainment industry in the near future.

For the sports tech industry, I think the long-term effects of more funding opportunities are likely to be more positive. As we’ve already seen with the footwear and apparel industry, the increased funding and market revenues available today have already bred additional competition and consumer options. I’ve written about this previously, but I do think the number of companies competing in the sports tech space will increase dramatically in the coming years. If the overall sports industry contracts or a bubble bursts, there will certainly be a commensurate shrinking of the sports tech market, but I believe we’d land in a place where the individual dominance of single companies has given way to a more varied and sustainable landscape of companies.

Of course, if I had perfect oracle-esque abilities to predict these types of impacts, I’d have already used them for predicting the future in other areas, perhaps by saving my old Pokémon cards to start…