Predicting a Slam Dunk, Airball, or a Third Basketball Metaphor for a Product Launch

Applying Sequoia's product-market fit framework to the world of sports tech

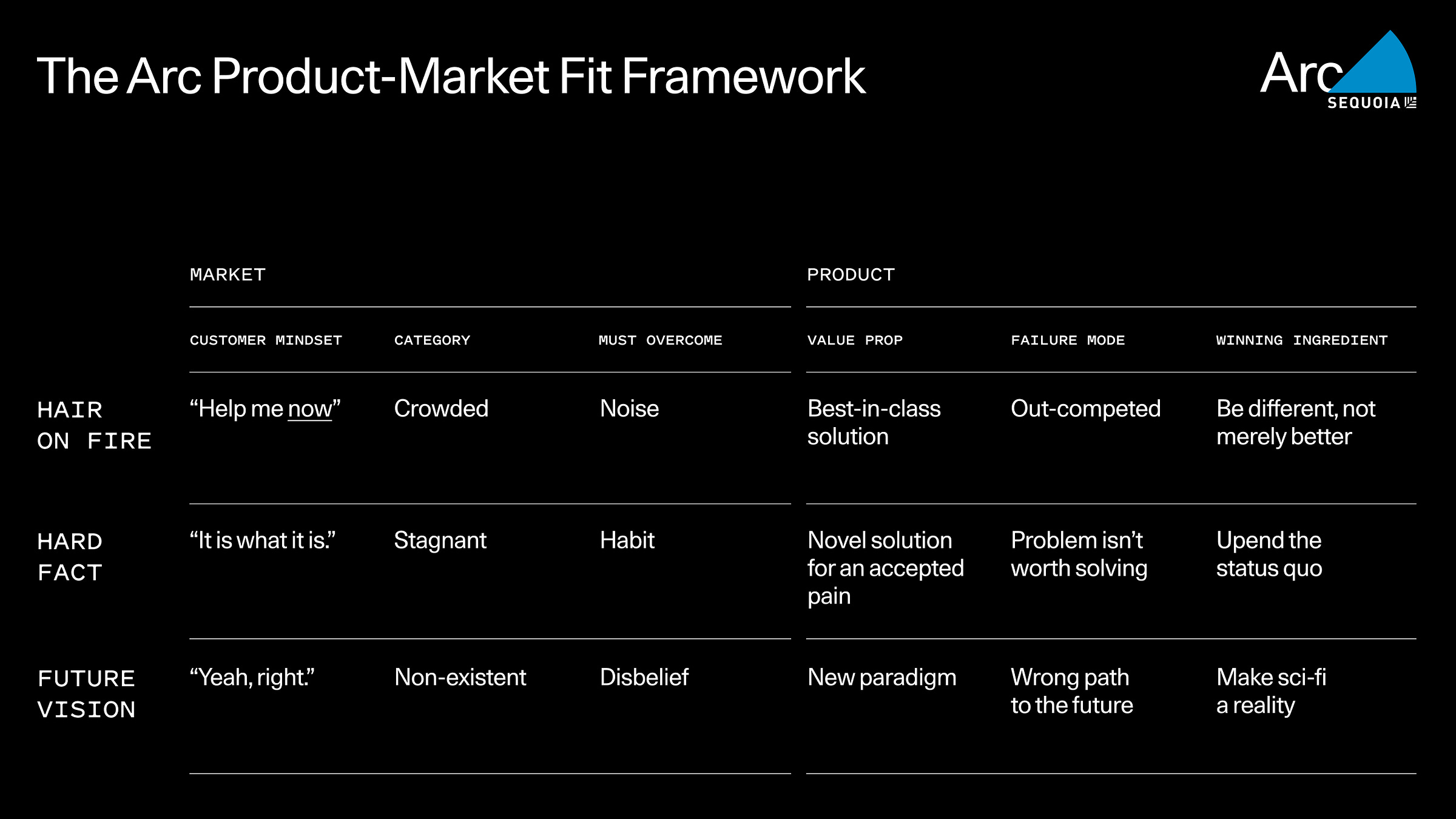

This spring, the venture capital (VC) firm Sequoia began releasing materials from its startup incubator Arc, which it launched in 2022. As a part of this release, they published a framework for assessing the product-market fit (PMF) of a new product or business. The framework helps startups assess the basic mindset of their customer, the high-level state of the market, and how these two factors influence what your new product needs to achieve to capture customers depending on its position in the market.

The first time I read through the framework, I A) was impressed by how resonant the categories of the framework were (turns out when you spend a long time thinking about PMF and launching successful companies, you create good tools for assessing markets) , and B) immediately started thinking about how sports tech and entertainment products and startups would fall into these archetypes. So here we are, with this article providing some examples of PMF from around the sports world, and hopefully a couple useful insights tacked on throughout!

The overview of the framework is below, and I highly recommend reading their article linked above on its construction— the content is pretty critical context for this article!

To be relatively derivative, sports tech products typically service three different segments of customers: individual athletes, teams, and leagues (organizing bodies). And to be even more derivative in my binning of customer needs, I see athletes typically seeking products that focus on performance, career longevity, recovery, and possibly style. Teams often hunt for products that improve strategy, logistics & athlete support, fan experience, and are frequently in charge of sourcing products that help their individual athletes as well. When it comes to sports tech products, leagues tend to look for ways to improve player safety, viewership (popularity), fairness, and planning.

Sequoia’s framework centers around three archetypes of PMF: “Hair on Fire,” “Hard Fact,” and “Future Vision,” and my initial thought was that these three archetypes might generally correspond to the types of products and markets that we see for individual athletes, teams, and leagues, respectively— an overly elegant grouping that I don’t think actually reflects reality. Categorizing products that target athletes, teams, or leagues may be a useful way to break down the sports tech market by the typical problems of its customers, but each of these users is met with new products that fall into all three PMF archetypes.

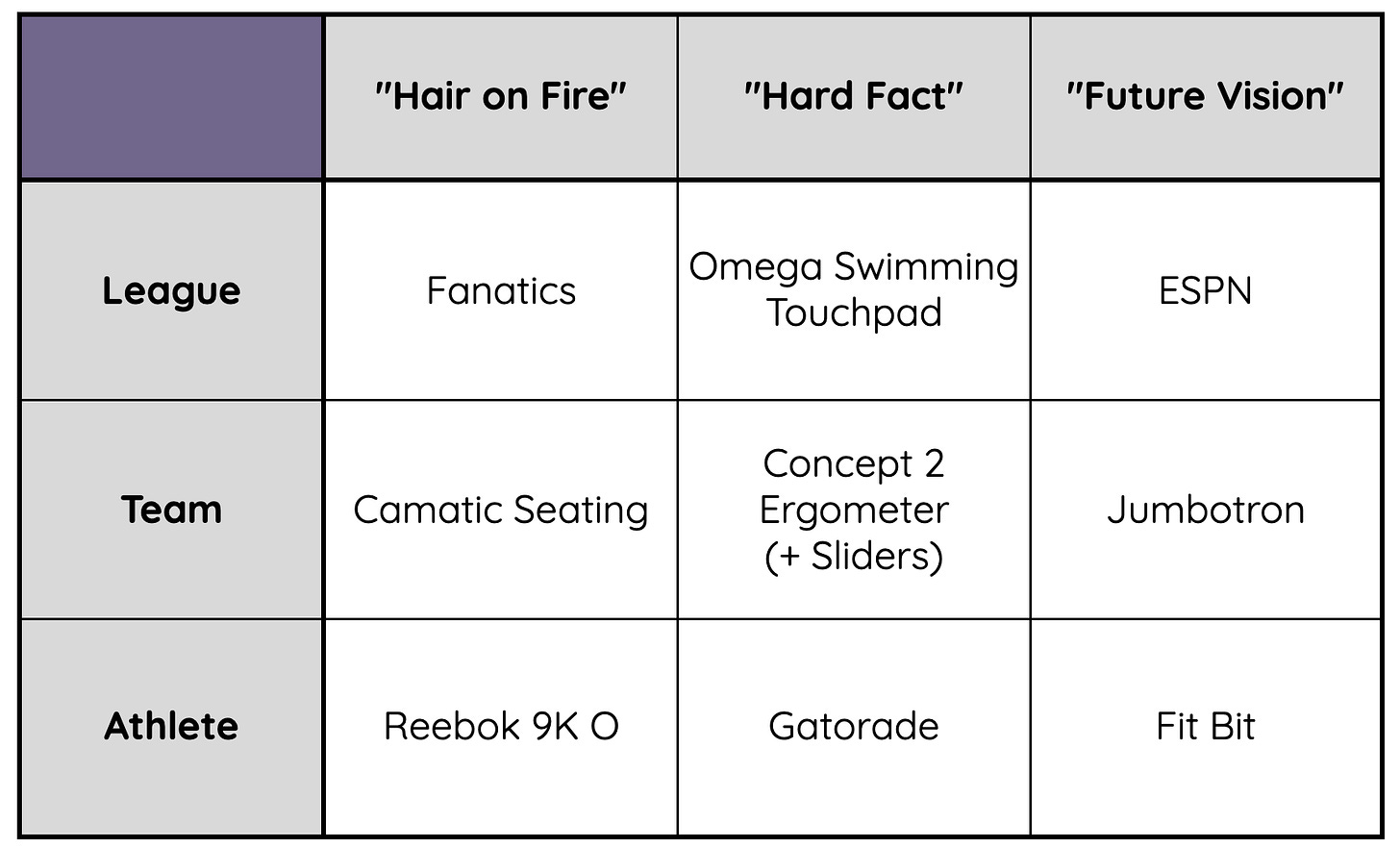

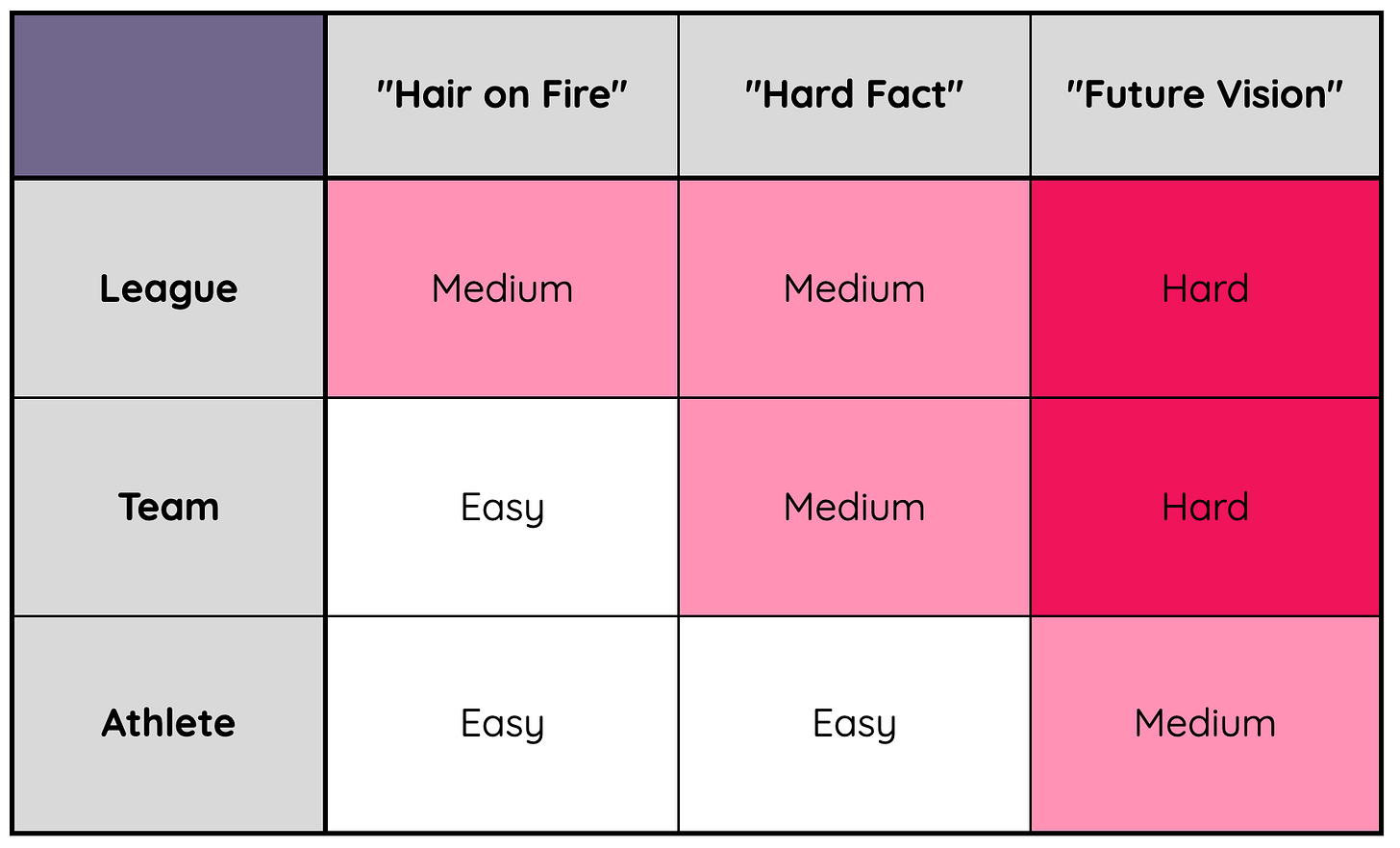

I reached this (probably obvious) realization thinking quickly about “legacy” sports tech products that have hit the market. It was easy enough to identify a handful of older sports-related companies and products that fit into some of the archetypes for players, teams, and leagues, which gave me the false confidence it would be easy to complete and share a full matrix of example products from history— effectively the nexus of this entire article. It turns out it is doable. BUT, it was very difficult to pinpoint offerings at certain intersections of PMF archetype and customer segment (more on this later).

After nearly giving up a couple dozen times, I landed at the matrix below. I’ve included links to these products or companies and a brief description of each after the matrix itself.

Legacy Products and Companies:

Fanatics: A company launched with a differentiated, digital way of selling sports apparel and merchandise in a competitive market.

Omega Swimming Touchpad: The first automated swim race timing system ended the days of manual race timing.

ESPN: A now-ubiquitous broadcasting company, ESPN was really the first major effort to have a TV station dedicated to sports— a prescient vision.

Camatic Seating: An Australian company, Camatic Seating battled its way into a bustling sports arena and venue seating market.

Concept 2 Ergometer (+ Sliders): The C2 rowing machine and the sliders that let rowers train together off the water are still dominant today.

Jumbotron: The first mega-screen offering for sports arenas. What should we put on it? Let’s find out together!

Reebok 9K O: A composite hockey stick that had holes in the shaft for higher rigidity and better aerodynamics. A gimmick? Maybe! But it stood out in the hockey stick market.

Gatorade: The first major sports drink that helps boost performance with sugar and electrolytes, making on-field dehydration a thing of the past.

Fit Bit: What started as a basic step-tracking product quickly exploded into the modern market of health and fitness trackers today.

Something that immediately struck me when looking at this matrix is how most of these products have now transitioned from right-to-left to become pretty ubiquitous product types in crowded, competitive markets. Maybe the clearest examples of this are the three “Future Vision” products with ESPN, the Jumbotron, and Fit Bit. Each of these products was an early cornerstone for the sports television, in-stadium entertainment, and the hotly contested smart/GPS watch markets respectively. Across the board though, you can identify types of companies and products that are everywhere in the sports world today— I would certainly love to go back in time and see the early journey for some of these companies.

The second thing that didn’t so much strike me, but slowly consumed me, was the difficulty of finding or ideating example products at the intersection of certain archetypes and customer type. In particular, I struggled most to think of products aimed at leagues, and found it difficult to pin down “Future Vision” PMF examples across all customer segments. Particularly for sports leagues, I think part of my struggle comes down to lack of familiarity with more entertainment- and planning-oriented products.

However, I think another reason it took me a long time to identify PMF examples in the “Future Vision” archetype across all customers is that they simply aren’t super prevalent in the sports tech world. Professional athletes, teams, and leagues focus so much on winning games and views in the short term that products promising the next great leap in competitive edge 5 years from now don’t really have eager customers. I do think this mindset is changing, though, as sports leagues and teams have launched their own investment funds in recent years to capture the sports market of the future much earlier than they have previously.

On the back of this insight, of course, I ended up getting the itch to look at the modern market of new products and startups to see if the distribution of companies in the matrix has changed. Thankfully, this ended up being a much easier task than finding historic examples.

Modern Products and Companies:

Venu Sports: New mega sports-broadcasting stream partnership trying to become financially viable.

Guardian Cap: On-helmet safety padding for football players, now mandated in certain practice scenarios by the NFL and NCAA.

NFL “All Day”: The NFL’s NFT-based digital trading card platform— the first major launch of its kind that’s seen some early traction.

CrewLAB: A young startup trying to streamline team and athlete training/schedule management, with a focus on endurance sports.

Catapult: A team training load and performance tracking products that launched as a “Hard Fact” product, but sits in a “Hair on Fire” market now.

Helios: A hockey-specific team and athlete performance and puck- tracking product that incorporates technology less prevalent on the ice.

Apple Watch Ultra: Apple’s GPS watch aimed at outdoor enthusiasts that launched into a very crowded, competitive market.

Volley: An AI-based ball machine for tennis and other paddle sports. You think solo training in tennis is boring? Think again.

Calorify: A startup aiming to make metabolic testing for athletes mainstream. It’s a lofty goal!

In general, I still had more challenge selecting offerings in the “Future Vision” archetype and league segment, but overall the exercise was much more straightforward. Part of this may be my personal familiarity with modern sports tech products and companies. I think the higher quantity of sports tech companies and products on the market today plays a part in making this exercise easier, though. In particular, the boom of sports tech software companies and athlete health/nutrition companies has increased the pool of products to pick from dramatically.

It’s interesting to think about how modern companies on this matrix may repeat the cycle of moving the market from “Future Vision”-oriented into “Hair on Fire” over time. Will the NFT trading card product of NFL “All Day” become popular with other leagues? Will Calorify’s direct metabolism testing product eventually breed copycats that compose a competitive market? As the framework suggests, the way these questions are answered will depend on whether or not they have predicted the future desires of customers well and can actually pave a financially viable path to that future (in other words, I’m not really sure, but I’m excited to find out!).

In any case, for anyone thinking about launching a new sports tech company in the near future, I hope this brief introduction to the framework and some examples has sparked some insights about whom to target with a product, and how. I had three major takeaways from this exercise.

First, although it appears to be changing now, I believe the sports tech market really cultivates the majority of its PMF in the “Hair on Fire” and “Hard Fact” archetypes, while “Future Vision” products tend to meet the market on less relevant time scales for customers. Second, it’s likely more difficult, but potentially more rewarding long-term, to target leagues with products, and apart from transformative safety and measurement hardware, I think this market is dominated by new software and entertainment offerings. Finally, and less tactically, it’s extremely difficult to reflect on market and product launch dynamics that you didn’t experience yourself, and I think a lot of our perception of the PMF of old products is based on emotional or qualitative assessment— I know mine was.

As always, If you agree or disagree with my assessment of where these companies and products fall within the PMF framework, definitely let me know! It was a lot more challenging than expected to fill them out, but I recommend making your own matrices if you get a chance!