How Long Until We Hit the GAAS (Gear as a Service) Pedal?

Disparate musings about the state and future of the outdoor gear market

The outdoor gear market can be nothing if not overwhelming— mentally, emotionally, physically. Two weeks ago I began hunting for a new pair of trail running shoes and was overrun with so many options and reviews that I just hunted for any pair mentioned in a “Best Trail Running Shoes of 2024” article that was on sale at the time. As I was traveling to Steamboat from Boston last winter, I saw a family with 23 kids traveling through the airport; the parents crumbling under the weight of 42 pairs of skis, boots, and layers. Perhaps a slight exaggeration in my effort to show that the burden of assessing, purchasing, and utilizing some outdoor gear is higher than it’s ever been.

The outdoor gear market is dynamic enough that I wanted to pull together some of my more disparate thoughts about its state and future into a single article, which is admittedly structured in a slightly funky, but hopefully cogent manner. Each section begins with an observation or assertion about a current state or trend of the broad outdoor gear market, then provides a brief analysis of what the short-term impacts of this dynamic are, with some second-order, future-looking predictions sprinkled in as well (a little if-this-then-that). Despite the disparate nature of the assessments and predictions, many generate related market impacts, so the ride through this article might be a bit circuitous, but ideally leaves you with a couple intriguing insights!

If I had more time, I would have written a shorter article condensing my thoughts, so in the interest of time, let’s drive into the world of outdoor gear!

Increasing Opportunity

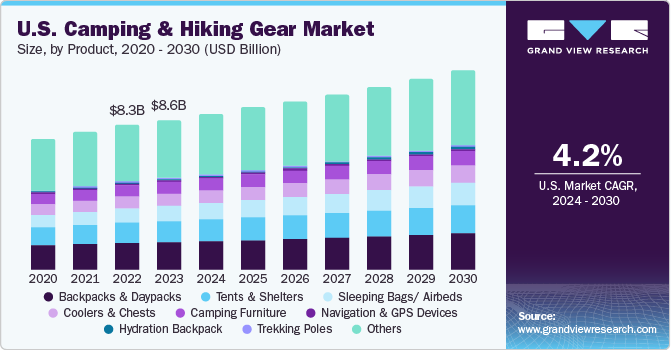

Assertion: The overall market size of the outdoor gear market is increasing at a rapid, and seemingly reliable pace. Depending on the market segment and preferred growth prediction source, the compound annual growth rate (CAGR) of the outdoor apparel and equipment market may fall in the 4%-10% range over the next 8 years.

If the tidal wave of private equity (PE) funding and venture dollars being funneled into sports teams and leagues is any indication, sports-centric markets like outdoor gear may receive major funds in the next few years. If Amer Sports realizes significant gains from its outdoor-focused brands with Arc’teryx and Salomon or companies like Adidas and Nike see continued growth in their trail footwear lines, it may drive an acceleration of supply-side growth in the market. If this happens, I think the current projected growth of outdoor gear market segments may actually be under-estimations. If I’m correct, this overall increase in market size and opportunity may have some interesting impacts, some of which are already starting to appear.

In somewhat of a chicken-and-egg scenario, the expanding market value will certainly spark the creation of new upstart gear companies, increasing the options for consumers across most market segments. We’ve already seen an upheaval in the athletic footwear market with companies like On and Hoka scraping market share away from incumbents like Nike, and it seems like every week a new bespoke bicycle manufacturer pops up to compete with the likes of Trek and Canyon. I would not be surprised if a similar pattern manifests in other segments like the coat or tent markets.

This increased competition has some interesting secondary implications as well, starting with a theoretical boost to companies that sell multiple brands. The REI’s of the world should really be able to draw in crowds by showing customers the wide variety of options they have available, especially as those options grow more abundant and confusing to assess. I also think this will drive more strategic and niche beachhead market selections for companies looking to launch new products. Gone are the days of needing to just come up with something slightly different than Nike and Adidas— nowadays you probably gain traction best by targeting a very specific subgroup of outdoor gear customers and expanding from there.

Steamboat Springs and the Dispersed Future of Outdoor Gear Brands

Steamboat Springs, Colorado has been featured in a wide variety of articles highlighting great ski towns in the Rockies. Whenever the town is mentioned in popular media outlets like the New York Times, you’ll often see a stream of responses in the comments section describing how the town is actually a terrible place to visit and no one should go there (…

A steadily increasing market size is almost guaranteed to attract new investment and business models as well. This may come in the form of funds consolidating brands together (more on this later) or venture capital being allocated to more companies around the world (like my older article above highlights). Especially with general fitness becoming a greater focus for a much broader general consumer base, investors likely see the outdoor gear market as one to target. Within the sports equipment and outdoor gear market, this type of investment might draw employees and companies from more traditional “VC/Tech” backgrounds, which could likely decrease the “passion tax” that you often see associated with salaries throughout the world of sports. Certainly a minor impact, but worth noting.

Escalating Product Costs

Assertion: The prices of outdoor gear across most segments (especially skis, bikes, and coats) are increasing.

If you’ve looked at the prices of a premium ski jacket from Patagonia or (God save your wallet) Norrona, you’ve probably seen first-hand how expensive high-quality outdoor gear has become. I certainly don’t mean to assert that this is necessarily a new trend, or ubiquitous across all segments within the gear market, but broadly speaking, purchasing and transporting outdoor gear is more expensive than it has ever been (thank you steep baggage fees).

As a result, I believe that gear rental categories will continue to expand, touching even more products that are required for specific outdoor activities. If top-of-the-line coats end up costing as much as skis to purchase, it wouldn’t surprise me to see gear rental shops offer apparel, shoes, and even things like water bottles for consumers— leaning even more into a one-stop-shop rental model for travelers. Perhaps we’ll end up with larger equipment vendors offering yearly subscriptions for total outdoor gear rental coverage (Gear as a Service— GAAS, if you will), or maybe we’ll even end up with an “AirBNB of outdoor gear,” where you can rent out your own personal gear to people visiting town!

In a double threat, I think people will also look for opportunities to better maintain their gear through repair and laundering, and will buy and sell more used gear. Companies like Patagonia, Arc’Teryx, and REI are already positioning themselves for this trend by opening their own marketplaces for used gear, and the Arc’Teryx store in Boulder also has a free technical gear laundry service for customers. I expect similar business models to launch for competing brands soon. This may spawn businesses dedicated to maintaining gear, much in the same way that dry cleaners do, and inspire more structured 3rd-party marketplaces similar to Poshmark or ThreadUp for used sports gear. Play It Again Sports was/is ahead of its time!

Perhaps in extreme cases, consumers may be drawn to relatively less-expensive outdoor sports more broadly as well. Would-be mountain bikers may opt for trail running, or skiers might look to grab a touring setup and completely bypass the high cost of a ski lift season pass when they decide to update their setup. This type of movement could upend more traditionally popular outdoor activities like resort skiing, which in turn could have dramatic effects on the consolidation we’ve seen in the ski resort market. What could take their place? I’m not sure, but we may find out!

In many ways, having a higher-price gear market also enables greater competition from smaller companies that cannot leverage economies of scale to compete at lower prices. Small businesses that can only produce coats in the $500+ range, or bikes above $5,000 actually find themselves in pretty crowded product price tiers with “name brands.” This creates additional competition and supply, which in theory should reduce gear costs broadly. In practice, I’m not particularly convinced this would actually occur since many brands are definitely positioning themselves as “premium” or “luxury” outdoor gear providers and may not want to lose this perception, even in the face of declining sales in the short term.

Increasing Consumer Options

Assertion: More companies than ever before are making every type of outdoor gear, and the number increases constantly.

Convergent Product Design & The Marathon Du Mont-Blanc

At the end of June, I was lucky enough to travel to Chamonix to watch my wife run the Marathon Du Mont-Blanc trail race. The lead up to the race involved a taper-killing (or boosting) mix of mountain bikin…

I wrote about this observation last year in my Marathon Du Mont-Blanc recap, and the trend is even more obvious today. It’s easier than ever to replicate the design, manufacturing, and distribution of competitor’s outdoor gear products— at least the non-patented ones. I’d like to coin the term for this high quantity of brand offerings for each type of product in the market as “high density.” What separates the 29 options you have when purchasing a piece of gear is oftentimes not clear, but it’s obvious that each company wants to keep you in their ecosystem of product by offering one of everything. Spoilers, though, it’s likely they could be doing more to conjure this type of brand loyalty!

I would guess that, similar to overall market expansion, this increased competition and optionality would lift up consolidated gear vendors like REI. While the current performance of the company might not support that hypothesis, I do think these in-person stores that present multiple options will become more popular as the decision paralysis of hunting through dozens of websites and comparing options online is brutal.

Converting most gear segments into “Hair on Fire” product-market-fit archetypes will likely prompt an emphasis on aggressive marketing and advertising campaigns that are common in the direct-to-consumer online marketplace (see Away, Warby Parker, Allbirds, etc.). As frustrating as it might sound, I think many brands will likely succeed based on marketing and ability to reach customers rather than deploy unique features.

I do think this type of market crowding will begin to breed more “Future Vision” innovation efforts, especially for the larger public companies creating outdoor gear like Nike, Amer, and Adidas. These players need to find the next big thing, and as their short-term prospects erode with increased competition, it may drive more moonshot initiatives, which is extremely exciting. A great recent example of this secondary effect is Arc’Teryx teasing a robotic hiking assistance device.

Poor Brand Loyalty Programs

Assertion: Despite increasing competition and brand accessibility, few individual gear companies give strong (or any) incentive to maintain loyalty.

To me, this seems like the most easily-addressable market observation in this entire article. Apart from aggregated retailers like REI and Backcountry, most individual brands don’t have any consumer rewards or benefits programs, which is shocking in a space where the competition for every type of product is so intense, and something as simple as a 20% discount on every 4th piece of XYZ Brand gear you buy might really drive consumer behavior changes. Part of me wonders if the seasonal sales common to individual outdoor gear markets really mitigate the need for these types of programs, but I have to imagine they would still be heavily utilized and influential.

The most logical short-term impact from this void is that companies will start to roll out loyalty and rewards programs. Especially for companies like Black Diamond or Salomon that offer a very wide range of gear, it seems so logical that it prompts quesitons about why it hasn’t been done yet. Ironically, loyalty programs becoming more common may actually accelerate the consolidation of gear brands (see below), as a company like Amer Sports can offer rewards programs across its entire family of brands— similar to airline cohorts like the Star Alliance, or others whose names I can never remember.

This type of consumer reward likely draws more direct-to-consumer sales for the brands, which might actually negatively impact sellers like REI, leading to a broader landscape of competitive incentives across the board. I can’t wait for a Mammut-branded credit card to hit my wallet.

Specialized Materials & Technology

Assertion: The materials and mechanisms that compose outdoor gear are actively becoming more complex and specialized.

This trend certainly coincides with rising costs in the outdoor gear market. Everything from trail running shoe foams to electric derailleurs to lightweight raincoat fabrics are becoming more unique and difficult to maintain due to technology or material innovations. While these new features push forward performance in key ways that entice customers (energy return, comfort, mobility, breathability, etc.), they may have some unintended effects.

Consumers may find themselves seeking external services to maintain and extend the useful life of their gear. Specific textiles or fabrics might requires super unique detergent (like dry cleaning), or e-bikes and electrical shifting may become so complicated that you effectively need a car mechanic to maintain your bike. I think that this will almost certainly prompt the rise of additional specialty gear care shops like specialized laundry services, gear repair shops, and beyond. (Given my second mention of this type of service, it’s probably clear I believe these types of businesses will become common)

It also wouldn’t surprise me if there was a renaissance of “retro-reliable” apparel and gear that is easy to fix and maintain. If the Toyota V6 fan club is any indication, I could see a big push for skis and bikes that are “dumbed down but stupid easy to fix.”

Consolidation, Consolidation?

Assertion: Large companies and investment funds are seeking to group compelling mixes of outdoor gear companies under a single umbrella.

Companies like Amer Sports (owned by another umbrella company Anta Sports) and brands like Adidas have gone on acquisition sprees over the past couple decades in order to consolidate popular brands in individual sports under the same name. I honestly don’t know that we’ve seen the fruits of such labor actually ripen fully, but I don’t think that will slow down this trend.

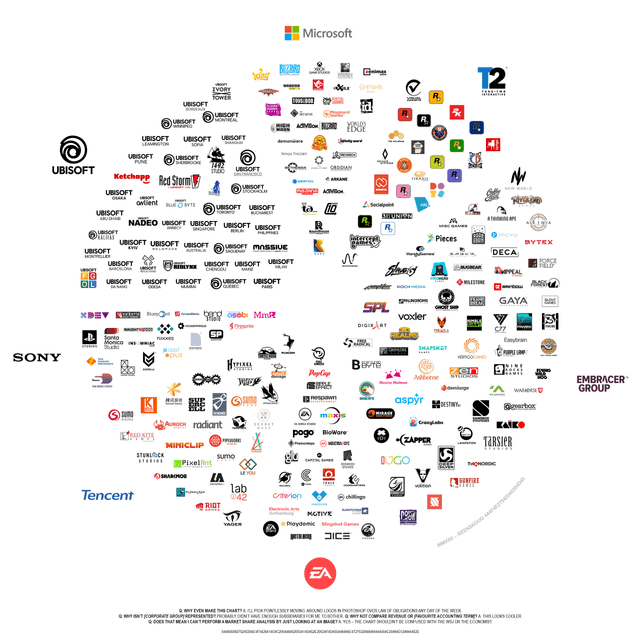

PE funds and other investors probably see Amer Sports’ IPO and think that they can acquire and loosely tie together a bunch of outdoor gear brands under one name and make a killing by launching into public trading (honestly, it kind of sounds like a SPAC when described like this). I generally believe this type of M&A activity is unsustainable in the long run and will lead to individual brand closure, so I would anticipate that some beloved smaller brands might get cut or consolidated into other brands if they are acquired by larger entities. This type of behavior is quite common in the Video Games industry, for better or worse.

A continued spree of acquisitions of small gear companies might also breed additional market competition, somewhat paradoxically. If I thought there was a good chance I could bootstrap a gear company for a niche product and sell it within 3-5 years, I’d likely attempt to do that (and maybe I will)!

Outdoors Online

Assertion: More people are bringing cellular- and satellite-connected devices with them into nature and during outdoor activities.

This assertion simultaneously states the very obvious, and presents possibly the most opportunity for completely new product categories. Almost everyone carries (or wants to carry) devices with bluetooth, cellular, or satellite connectivity into the wilderness, which provides unprecedented levels of data gathering and information transfer during outdoor activities. The ideas about how to leverage all this connectivity abound!

The demand for devices that provide power in outdoor spaces will continue to rise. Whether this comes from solar chargers, portable battery packs, or yet-uninvented products (maybe some mini hydro generators on trail streams?), products that enable reliable power generation will continue to gain popularity. Once you have power available with you at all times, it can also be used for more products beyond just communication devices, from personal drones to safety devices (e.g. mobile flares or avalanche beacons) to mobility assistance units. The possibilities are endless.

I think in some ways this might also encourage more people to take outdoor trips that they otherwise would deem too risky or potentially unenjoyable. If you have constant communication all over the globe, it might promote more people to backcountry ski or through-hike long routes they’d otherwise avoid.

More products that leverage crowd data may become viable and broadly used as well. Similar to the way that maps providers like Waze both provide a service and use customer data to enhance the product, it wouldn’t surprise me if the lift line estimates ski resorts use with cell data extend to live looks at the popularity of trails and routes on apps like AllTrails or Strava.

If these apps begin to pull live user data, it also sets the stage for the capture of other data that phones can produce like hyper-local air pressure or humidity. The increase of software features may also pair well with unique sensors that are Bluetooth enabled, or networked independently. Especially for types of information that phones themselves are not able to produce, it’s not a major leap to think that companies who can use unique hardware provide this information could have new, large customer bases.

A Changing Landscape

Assertion: The form of the outdoors themselves are changing, as global climate change affects ecosystems in predictable and unpredictable ways.

In general, I think it’s difficult to make sweeping interpretations about consumer product trends that stem from climate change, but a few short-term impacts stick out to me.

First, people are more eager to experience certain natural beauty “before it’s gone,” which places an increased premium on outdoor activities that involve glacial and reef environments and the products associated with visiting them. In some ways, this also applies to activities like skiing, especially on the east coast. Somewhat cruelly, this type of activity may itself decrease the lifespan of these ecosystems even more quickly, which puts pressure on ecotourism destinations to adapt their offerings— not dissimilar from more ski resorts beginning to offer downhill mountain biking in the summer.

Second, those spending time in the outdoors are becoming more in tune with their impact on the environment. You often see carbon offset pledges when signing up for trail running and cycling races online nowadays, and although I’m often skeptical of the efficacy of such mechanisms, it’s clear that outdoors-people crave products that affect the environment less— which can influence manufacturing materials, processes, and re-use of gear.

I’m thinking extremely far outside the box here, but I do periodically wonder if the use of petrochemical compounds in outdoor gear (which are practically in everything) will eventually fall out of favor, and brands like Fjallraven or Mons Royale that use more natural fabrics and components will become more popular. I really think something dramatic would have to happen for this to occur in full, but it’s easy to see how brands like Patagonia can draw in new customers through an environmentally-focused mission.

Closing Thoughts

If this article is any indication, there are so many complicated dynamics at play in the outdoor gear market that is practically guaranteed to change in dramatic ways within a decade. To convert my broad musings and assessments into actionable insights, though, I think you have to focus on very specific problems and product segments. The trail running shoe and mountain bike helmet markets will no doubt share some trends and exhibit unique trajectories due to nuances about the technology and business model opportunities they present. How existing and new companies seek to attack these niches or bundle offerings together for broad customer bases will be extremely fun to watch unfold. The only thing I know for sure is that there will be surprises along the way.

And who knows! Maybe in 2030, you can open up the Amer Sports website, make sure your $2,500 annual family subscription payment went through, check your measurements, and begin filling out your schedule of adventures for the next year. Trail running in the White Mountains in April (muddy) Mountain bike trip to MOAB in late October, and two ski trips in Steamboat and Killington in December and early March. Then, you sit back and know that you can pack your single carry-on and personal item on all your trips and everything you need for these adventures will be at a local store when you arrive: helmets, skis, bikes, gloves, bike shorts, shoes, jerseys, coats, and beyond. All you need to do is wrangle your kids around the country with as few headaches as possible.